Whatever You Need to Learn About Equity Loan

Whatever You Need to Learn About Equity Loan

Blog Article

Utilize Your Home's Value: The Advantages of an Equity Finance

When thinking about economic options, leveraging your home's value with an equity loan can offer a critical technique to accessing added funds. From flexibility in fund use to potential tax benefits, equity car loans present an opportunity worth exploring for homeowners seeking to maximize their financial sources.

Benefits of Equity Lendings

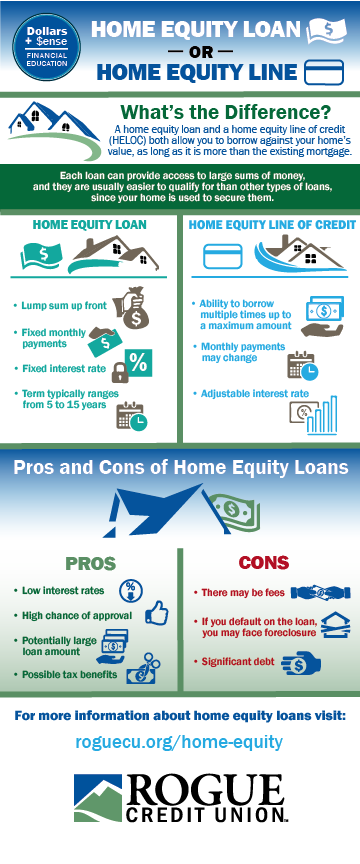

Among the primary benefits of an equity lending is the capability to access a large sum of money based upon the worth of your home. This can be particularly helpful for homeowners who call for a considerable quantity of funds for a specific purpose, such as home renovations, financial debt consolidation, or significant expenses like clinical expenses or education costs. Unlike various other kinds of loans, an equity car loan generally supplies reduced rates of interest because of the collateral supplied by the building, making it a cost-efficient borrowing option for several individuals.

In addition, equity car loans commonly offer more versatility in terms of payment timetables and loan terms contrasted to other types of financing. Overall, the ability to accessibility considerable sums of money at reduced interest rates with flexible repayment alternatives makes equity fundings a valuable monetary device for home owners seeking to take advantage of their home's worth.

Adaptability in Fund Use

Provided the beneficial borrowing terms connected with equity financings, homeowners can successfully use the flexibility in fund use to satisfy different economic needs and objectives. Equity finances offer home owners with the freedom to use the obtained funds for a variety of functions. Whether it's home renovations, financial obligation consolidation, education and learning expenses, or unforeseen clinical bills, the flexibility of equity fundings permits individuals to address their monetary demands efficiently.

Unlike some various other types of lendings that specify exactly how the obtained money should be invested, equity loans supply consumers the freedom to assign the funds as needed. Whether it's investing in a brand-new service venture, covering emergency expenditures, or moneying a significant purchase, equity car loans encourage homeowners to make tactical financial choices lined up with their objectives.

Potential Tax Obligation Advantages

One of the key tax obligation benefits of an equity car loan is the capacity to deduct the rate of interest paid on the lending in particular circumstances. In the United States, for instance, passion on home equity loans up to $100,000 might be tax-deductible if the funds are utilized to enhance the home securing the loan.

In addition, utilizing an equity funding to settle high-interest debt may also bring about tax obligation benefits. By settling charge card financial obligation or various other loans with greater rate of interest using an equity car loan, house owners might be able to subtract the rate of interest on the equity lending, potentially saving much more money on taxes. It's essential for home owners to talk to a tax advisor to understand the certain tax obligation effects of an equity loan based on their individual circumstances.

Lower Rate Of Interest

When checking out the financial advantages of equity lendings, one more crucial facet to take into consideration is the potential for home owners to secure lower passion prices - Home Equity Loan. Equity car loans commonly supply reduced rate of interest contrasted to other kinds of borrowing, such as individual loans or charge card. This is since equity car loans are secured by the value of your home, making them less high-risk for lenders

Lower rates of interest can result in significant cost savings over the life of the financing. Also a little percentage distinction in rate of interest can convert to considerable financial savings in interest payments. House owners can utilize these financial savings to pay off the financing quicker, build equity in their homes quicker, or buy other locations of their financial profile.

Furthermore, reduced rate of interest rates can improve the general affordability of loaning against home equity - Alpine Credits. With minimized rate of interest costs, house owners might locate it less complicated to handle their regular monthly repayments and preserve financial security. By capitalizing on lower passion rates through an equity car loan, house owners can leverage their home's value much more properly to fulfill their monetary objectives

Faster Access to Funds

Property owners can quicken the procedure of accessing funds by using an equity funding safeguarded by the value of their home. Unlike various other funding alternatives that might include extensive authorization treatments, equity car loans offer a quicker course to acquiring funds. The equity accumulated in a home acts as security, providing loan providers better self-confidence in prolonging credit rating, which streamlines the authorization process.

With equity lendings, home owners can access funds quickly, often receiving the money in a matter of weeks. This fast access to funds can be critical in scenarios requiring instant financial assistance, such as home restorations, clinical emergencies, or financial obligation loan consolidation. Alpine Credits Canada. click for more info By touching into their home's equity, home owners can swiftly resolve pressing economic requirements without prolonged waiting durations usually connected with other kinds of car loans

Furthermore, the structured procedure of equity car loans converts to quicker dispensation of funds, enabling home owners to take timely financial investment possibilities or handle unanticipated expenses successfully. In general, the expedited access to funds with equity finances underscores their practicality and comfort for home owners seeking timely monetary solutions.

Final Thought

Unlike some other kinds of lendings that define just how the obtained cash should be spent, equity fundings offer consumers the autonomy to allocate the funds as needed. One of the key tax obligation benefits of an equity funding is the capacity to subtract the rate of interest paid on the lending in particular circumstances. In the United States, for example, rate of interest on home equity loans up to $100,000 might be tax-deductible if the funds are utilized to improve the residential or commercial property safeguarding the funding (Home Equity Loans). By paying off credit history card financial debt or various other finances with higher rate of interest rates utilizing an equity finance, homeowners may be able to subtract the passion on the equity financing, possibly saving even more money on tax obligations. Unlike various other lending choices that might include prolonged authorization procedures, equity lendings use a quicker route to getting funds

Report this page